The Value Portfolio - Recent Actions and Views - Post 5

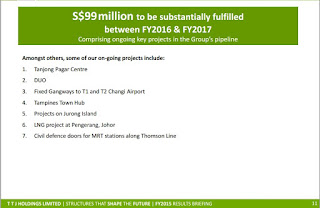

I am lucky enough to be in time to post my last blog post in 2015 - A review of my portfolio. My overall portfolio has not done well - it was down an average of about 5%. However, looking on the bright side, it is still better than how the STI performed over the year. The following are stocks in my portfolio: 1) ISDN Holding Limited + Post 2 2) Sin Ghee Huat Corporation Limited 3) PNE Industries Limited 4) Chuan Hup Holding Limited 5) LHT Holdings Limited 6) TTJ Holdings Limited 7) Accordia Golf Trust + Post 2 8) Singapore Telecommunications Limited 9) Sapphire Corporation Limited 10) Suntec Real Estate Inv Trust 11) Oversea-Chinese Banking Corporation 12) CH Offshore Ltd 13) Maxi-Cash Financial Services Corp Ltd 14) ST Engineering Ltd 15) Bukit Sembawang Estates Ltd + Post 2 16) PSL Holding Ltd 17) M1 Limited 18) Hock Lian Seng Holding Ltd 19) United Industrial Corporation Ltd Bought United Industrial Corporation L...