TTJ Holding Ltd - Fairly Valued?

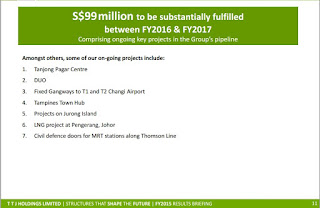

Now I shall write about another of my stock holding in the portfolio - another value gem found - TTJ Holding Ltd. Profile in Short TTJ Holdings Ltd is a company that deals with steel structure works and works on various government projects. It also operates one dormitory under the name of Terusan Lodge 1 in Singapore (but it will end in 2017 ~ A Cash Cow Gone!). However I am not worried after looking at the presentation slides below: Order Book For 2016 and 2017 Industry Outlook Potential Projects In addition, anyone who is interested in this stock should take a look at this forum thread (more good stuff)! The Value Stock Scorecard Price: $0.385 (as at 28 Sep 2015) Net Current Asset Per Share: $0.299 (-28.55%) % Cash of Price: 62.51% % Cash of Current Asset: 65.91% Cash/Debt: 506.687 times Discounted Net Asset Value: $0.316 (-21.69%) Price to Sales: 1.429 Earning Yield: 11.59% Dividend Yield: 20.78% (FY2015 Dividend has increased till 8 cents b...