Review Of Value Momentum Workshop

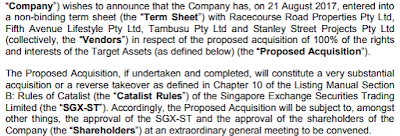

I went together with Simple Investor for Heartland Boy 's seminar on 21 Nov 2017 evening. I was interested in his investment theory – Value Momentum. After all, he had a picked a few exceptional winners over the last 3 years. Before I continue, I just want to say that I did met Heartland Boy at the Invest Idol competition previously. Although both of us did not make it to the final, he did left an impression on me. I am not sure if his theory started then, but at that time, I already felt that “this guy do know his stuff”. Eventually, at this seminar, he continue to show me that he does know his stuff WELL! Picture taken from InvestingNote's Blog - The Signal Blog The seminar started with Heartland Boy explaining he is a self-taught investor and his “Value Momentum” theory basically came about from reading Adam Khoo’s Winning The Game Of Stocks. In his words, this theory was basically 80% fundamental analysis (FA) and 20% technical analysis (TA) . This ...