From “Not-So-Big idea” To Big Idea 9

My initial draft did not conclude this purchase as another Big Idea. But after completing the draft, I decided that this investment is a Big Idea.

I will not be hiding the identity for this company because, at this point in time, I will have already revealed the company name on my Facebook Post.

Big Idea 9 became the talk of the town once the cooling measures were announced by the authorities, and within the same period, a bigger rival got listed.

This was evidenced from my research as well. There were so many articles written by analyst and bloggers (Thelittlesnowball, Motley Fool, Heartland Boy, PropertyinvestSG) that it was hard to find hidden information that could possibility sway me to the “other” side.

Do note that this investment is very new and resulted in my portfolio increasing to 16 companies.

I am NOT taking a step back in my consolidation of my portfolio. I have been looking at Big Idea 9 for many weeks before I decided to invest in it. The recent share price drop of more than 50% from its peak has make it too tempting not to continue to say “No”.

Reasons Why This Counter Qualifies as a "Big Idea"

(Do note that I will not be talking a lot on the financials in this post because it has been stated so many times in other blogs or write up.)

1. History

To really understand the history of Big Idea 9, you need to understand its history. The company was initially purchased by Northstar Group from Hersing Corp for $130 Million in 2013.

Then after almost 4 years, it was relisted at 66 cents which valued the company at $234.43 Million (Number of Shares = 355 Million).

At that price, it was an 80% gain for Northstar Group. Based on the number of shares, the breakeven share price for the initial purchase amount by Northstar Group is $0.366.

However, this was the price 4 years ago. For a Private equity firm that continues to own 72% of Big Idea 9, I believe the wait must be profitable.

After incorporating a 5% compounded gain over 4 years, the “supposed” minimum share price by Northstar Group will be $0.443. In fact I believe this is still too low for the private equity firms.

Nevertheless, this minimum share price is about 35% below the current share price, which in my opinion is not a huge buffer and Northstar Group will most probably not let it continue to slide further.

2. Time Lapse And Projects Secured

New cooling measures are announced on 6 Jul 2018. But the 2nd Quarter Results will be from April to June. Thus, the 2nd Quarter results that will be announced most probably in August 2018 should not reflect the sudden drop in property purchases due to cooling measures.

I will not be hiding the identity for this company because, at this point in time, I will have already revealed the company name on my Facebook Post.

Big Idea 9 became the talk of the town once the cooling measures were announced by the authorities, and within the same period, a bigger rival got listed.

This was evidenced from my research as well. There were so many articles written by analyst and bloggers (Thelittlesnowball, Motley Fool, Heartland Boy, PropertyinvestSG) that it was hard to find hidden information that could possibility sway me to the “other” side.

Do note that this investment is very new and resulted in my portfolio increasing to 16 companies.

I am NOT taking a step back in my consolidation of my portfolio. I have been looking at Big Idea 9 for many weeks before I decided to invest in it. The recent share price drop of more than 50% from its peak has make it too tempting not to continue to say “No”.

Reasons Why This Counter Qualifies as a "Big Idea"

(Do note that I will not be talking a lot on the financials in this post because it has been stated so many times in other blogs or write up.)

1. History

To really understand the history of Big Idea 9, you need to understand its history. The company was initially purchased by Northstar Group from Hersing Corp for $130 Million in 2013.

Then after almost 4 years, it was relisted at 66 cents which valued the company at $234.43 Million (Number of Shares = 355 Million).

At that price, it was an 80% gain for Northstar Group. Based on the number of shares, the breakeven share price for the initial purchase amount by Northstar Group is $0.366.

However, this was the price 4 years ago. For a Private equity firm that continues to own 72% of Big Idea 9, I believe the wait must be profitable.

After incorporating a 5% compounded gain over 4 years, the “supposed” minimum share price by Northstar Group will be $0.443. In fact I believe this is still too low for the private equity firms.

Nevertheless, this minimum share price is about 35% below the current share price, which in my opinion is not a huge buffer and Northstar Group will most probably not let it continue to slide further.

2. Time Lapse And Projects Secured

New cooling measures are announced on 6 Jul 2018. But the 2nd Quarter Results will be from April to June. Thus, the 2nd Quarter results that will be announced most probably in August 2018 should not reflect the sudden drop in property purchases due to cooling measures.

Furthermore, Big Idea 9's Q1 results has been great and it should flow into its Q2 results. This is similarly expressed in its latest annual report, which states that “To date, Big Idea 9 has already secured more than 20 projects to be launched in 2018, with more than 11,000 residential units available for sale. This is more than double the 4,800 units (from 9 projects) in 2017 and signifies greater growth potential for Big Idea 9 and more sales opportunities for its’ salespersons in 2018”.

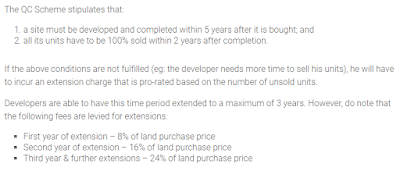

3. Enblocs And QC Certification

This was bought up by SG TTI on IN under Kenny Chia's Post. I guess it stuck a chord in me and it made me re-wire my thoughts.

From my research on the Singhaiyi post, you just need to look at the number of Enblocs completed/announced since the end of 2017 till June 2018! Just imagine the number of developments that will be continued to announced throughout the year, as well as the projects already secured by the company as stated in the point above.

|

| Screengrab taken from newcondolaunchonline.com |

Although one can argue developers can always delay the announcing of the projects, but they will still be required to sell all of the units within 7 years of completion. They have to make sure that these developments have to be SOLD one way or another.

During the not-so-long-ago initial cooling measures, if you had invested in developers then, you will have realised the actions developers take to “escape” such measures were never beautiful.

Furthermore, as expressed in the RHB analyst report, “For one, developers have started countering the measures with “more realistic” pricing and the offers of discounts of 5-10 percent in new launches, RHB said, adding that should draw more first-time buyers. Developers were also offering higher agency commissions of 3-4 percent at some launches, compared with the typical 1.5 percent, it said. It also noted that around 200 more units were sold last week at new launches, despite the measures.

Furthermore, around 35 percent of its first quarter gross profit from the “very stable” segments of non-brokerage income, leasing and HDB resale, it said.”

This was one of the reasons that resulted in me having a lack of confidence in its long term financials. However, after writing out my thoughts, it actually gave me more confidence of the company’s long term financials.

Do note that additional cooling measures will have impact on most probably in Q4 2018 and Q1 2019 financials, but at the current price, this impact should be “a piece of cake” for the EXPERIENCED LONG TERM HOLDING INVESTORS.

4. Future Expansion

The point of Future Expansion has been bought up by Heartland Boy in his initiation report. I do believe this will be a major catalyst for Big Idea 9 in the few years ahead.

|

| Screengrab taken from Heartlandboy Blog |

5. High Free Cash Flow

I always liked FCF generation companies. I believe, out of all the figures bought up by various bloggers and analyst, this was missed out.

|

| Cashflow Statement from Annual Report |

6. Property Agents Are Not Property Developers

Property Agents Services will be required, pending full digital disruption. However, one can always argue that SGCarmart has been around for the longest period of time and car dealers continue to be around.

Furthermore, do note that an oversupply in developments/cooling measures will caused major dents in a developers’ financials, but not for Big Idea 9 which just provide the agencies services.

In Short

Thank you for reading till the end.

Big Idea 9 is actually APAC Realty Limited.

Before I conclude, I must highlight that all big ideas have its risks. For APAC Realty Limited, its recent purchase of the new building will definitely impacted its cash holdings and its balance sheet will most probably be worse off.

Nevertheless, in view of the various positives and the significant share price drop, I had decided to invest in APAC Realty Limited and make it one of my big ideas.

Moving forward, it is important to continue to purchase the shares in batches as I believe the road ahead could be rather volatile for the company before it goes on a huge uptrend.

One of the major catalyst is the most probably on the company's ability to break out of Singapore and diversifying its revenue in different geographical regions. After all, the cooling measures will only impacts property developments within Singapore.

Please do your own due diligence before you invest this counter.

If you are interested to know how to measure a moat, do sign up with us to get the latest score of the moat of all the SGX counters now! At only $10 a month!

Oh... and do remember, please like our Facebook page (T.U.B Investing) and follow me on InvestingNote.

Comments

Post a Comment