How To Invest During A Weak Market?

Market has been moving on a downward trend. So how has your portfolio been doing?

If your portfolio is down more than 3%, you will have been better off investing in the STI ETF.

On the other hand, you may have exited many of your positions and will like to invest in companies that could probably be the fastest to rise back. You will be looking for companies that will be able to produce a “V” shape recovery and not a “U” shape recovery.

Being the scorecard creators, Simple Investor and I had continued to create our 3rd Scorecard – The Moat Scorecard (yes, I am repeating…).

We believe that a company with a strong moat will be able to withstand the volatility of our current market and even if its shares are on a downward trend, it will probably provide the investor with a “V” shape recovery.

For this post, I will not be repeating what about what the Moat Scorecard can do. But I will like to highlight on the backtesting we had done for this scorecard.

Oh... and do remember, please like our Facebook page (T.U.B Investing) and follow me on InvestingNote.

If your portfolio is down more than 3%, you will have been better off investing in the STI ETF.

On the other hand, you may have exited many of your positions and will like to invest in companies that could probably be the fastest to rise back. You will be looking for companies that will be able to produce a “V” shape recovery and not a “U” shape recovery.

Being the scorecard creators, Simple Investor and I had continued to create our 3rd Scorecard – The Moat Scorecard (yes, I am repeating…).

We believe that a company with a strong moat will be able to withstand the volatility of our current market and even if its shares are on a downward trend, it will probably provide the investor with a “V” shape recovery.

For this post, I will not be repeating what about what the Moat Scorecard can do. But I will like to highlight on the backtesting we had done for this scorecard.

|

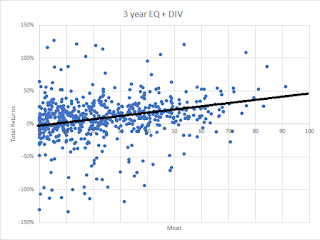

| Moat Score against Total Returns for 3 Year Holding Period |

|

| Moat Score against Total Returns for 5 Year Holding Period |

Through the graphs, you can see that if you invest in company with a Moat Score of 60 to 80, you will be getting a decent return of 25% to over 50% based on either a 3 years holding period or a 5 years holding period.

|

| Average Return vs Moat Score |

Furthermore, we have plotted the Average Return vs the Moat Score along with the removal of outliers that skews the data.

It seems like holding a company with a 80 to 90 Moat Score for 5 years will potentially give you a very good return of over 200%.

Thus, if you wish to know more about the Moat Scorecard, Simple Investor and I will actually be conducting a workshop on it.

The details of this investing workshop is as follows: -

Venue: 73 Ayer Rajah Crescent. The Meeting Point, Event Hall 1, Singapore 139952

Date: 24th September, Monday

Time: 7pm to 8.30pm

Please click on the LINK to purchase your tickets!

**Use exclusive promo code to get $6 OFF: EB37

It has been such a long time since both of us conduct a workshop together and we have been planning this workshop for a VERY LONG TIME.

Eventually, we just hope everyone whom attended this workshop will be able to return home learning something new about investing!

See you there!

Oh... and do remember, please like our Facebook page (T.U.B Investing) and follow me on InvestingNote.

Comments

Post a Comment