Big Idea 13

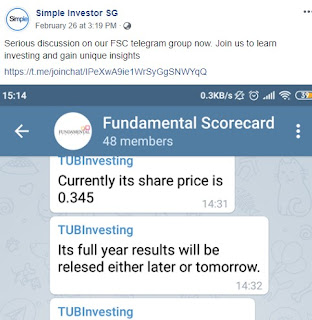

As indicated in my last post, I had already sold Big Idea 5. Therefore, I am still on the lookout for the next idea to invest in. Currently, for my Big Ideas Investing Theory, I have wrote about 12 Big Ideas and I had sold about 3 of them. Overall, I am still holding on to 9 of them which contributes about 60% to 70% of my portfolio. I caught a glimpse of Big Idea 13 on a valuebuddies forum. Then I went to work on it. I was so excited about this idea that I shared it on my Fundamental Scorecard Telegram Group. Then, Simple Investor shared it on his Facebook Page . Screengrab of Simple Investor Facebook Page OMG...this ballooned the members on my Fundamental Scorecard Telegram Group from 48 members to the current 130 members within 2 days. I am still very amazed by the support and will like to still say a Big "Thank You" to the old and new members in the group. So after my initial analysis on Big Idea 13, I came up with this summary. "The company has 2 ...