UVE - A Company That Thrive In The Most Competitive and Dangerous Landscape!

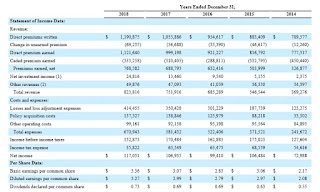

This post is a reminder for myself of why I invested in the above company. I am vested and comments maybe biased. Numbers/Finance Increasing Revenue, Net Profit, Dividend – Over the last five years, the total revenue has just been increasing. Although you can’t say the same for net profit, but on an overall basis, it has also been increasing. As for the dividend, it has also been increasing. Love it (Remember this trend and it will be explain further in the catalyst) . Source: FY2018 10-K Improving Balance Sheet – Balance sheet has been improving with the rise in total asset along with the rise in Book Value. ROE, Long Term Debt, Combined Ratio – Return on equity has dropped, but it has maintained at 20+%. But this ROE comes along with low Long Term Debt (Hint!) . In addition, just looked at the returns of UVE vs competitors. Furthermore, Combined Ratio* continued to remain below 100%. *As per Investopedia, “The combined ratio is a quick and simple way to mea...