UVE - A Company That Thrive In The Most Competitive and Dangerous Landscape!

This post is a reminder for myself of why I invested in the

above company. I am vested and comments maybe biased.

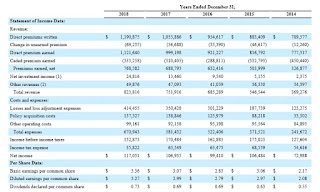

Numbers/Finance

Increasing Revenue, Net Profit, Dividend – Over the last

five years, the total revenue has just been increasing. Although you can’t say

the same for net profit, but on an overall basis, it has also been increasing. As

for the dividend, it has also been increasing. Love it (Remember this trend and

it will be explain further in the catalyst).

|

| Source: FY2018 10-K |

ROE, Long Term Debt, Combined Ratio – Return on equity has

dropped, but it has maintained at 20+%. But this ROE comes along with low Long

Term Debt (Hint!). In addition, just looked at the returns of UVE vs competitors.

Furthermore, Combined Ratio* continued to remain below 100%.

*As per Investopedia, “The combined ratio is a quick and

simple way to measure the profitability and financial health of an insurance

company. The combined ratio measures whether the insurance company is earning

more revenues from its collected premiums relative to the claims it pays out.”

|

| Source: Csimarket.com |

|

| Source: FY2018 10-K |

| Source: SeekingAlpha |

Reasonable Ratios – The ratios are not screaming “Buy Me!”

but they are definitely reasonable when compared to industry.

|

| Source: Csimarket.com |

Business Model

Property and casualty insurance Company Solely Operating in

the US – It is a holding company offering property and casualty insurance and

value-added insurance services.

Main Business in Florida – 85% of revenue generated in

Florida.

Now you must be wondering: Why Florida? It seems to be

appearing in the news VERY often due to Hurricanes. Just look at the number of

Hurricanes that had hit Florida as stated by Wikipedia! (Read Catalyst).

|

| Source: Wikipedia |

|

| Source: Investor Presentation |

An unknown Company – In “One Up on Wall Street”, Peter Lynch

stated to find companies Wall Street has yet to pounced on. Please read the

latest transcript in Seeking Alpha and look at the number of analysts covering

it. Its pathetic for such a good company!

Share Buy Back – In Dec 2018, UVE’s Board of Directors

authorized a new share repurchase program to repurchase up to $20M of its

outstanding shares of common stock through May 31, 2020. This new authorization

follows the completion of the $20M share repurchase program announced on

November 8, 2017.

Share Price Movement vs Improving Financials – I will be

expecting the share price to just keep going up due to improving financials.

Hmm… it does not seem like the case.

|

| Source: SeekingAlpha |

Reinsurance Program – This is the most important catalyst

for UVE and it also showcase its ability to survive in Florida despite being in

such a competitive and dangerous landscape. Do read their 10-k to understand

their reinsurance program. But basically, they reinsured their risk outwards

and expected loss is limited.

|

| Source: FY2018 10-K |

Risk

Catastrophic Event – In all insurance companies, the main

risk is catastrophic event. Although they have a great reinsurance program. But

what happens if the event hit the whole of US? Do note that they do have

businesses out of US.

Website Down Outside US (?) – This is probably a joke. But I

cannot seem to access their website. If you are working in UVE, it will be good

to reflect this to your management!

For those that is interested in the daily discussion of investing theories and companies, feel free to join our Fundamental Scorecard Telegram Group.

Hi.

ReplyDeleteGood luck to you!

May i know how much is your portfolio value now? Thanks!

Hi

DeleteNot huge - starting 6 figures.