Don't Get Trapped...

Yesterday, during our FATA Seminar's Stock Discussion, we discussed about some companies and I pointed out some of their issues in the financials.

Do note that for our FATA Seminar, we will allow participants to ask about some companies. After which we will discuss about these companies' FATA prospects.

Many of the issues came from S-Chips' financials, which many had already cautioned about.

However, we discussed about this Singapore company's in the F&B sector, where I mentioned about some figures in the financials that were presented very interestingly.

Let me explained some of the interesting findings:

Do note that for our FATA Seminar, we will allow participants to ask about some companies. After which we will discuss about these companies' FATA prospects.

Many of the issues came from S-Chips' financials, which many had already cautioned about.

However, we discussed about this Singapore company's in the F&B sector, where I mentioned about some figures in the financials that were presented very interestingly.

|

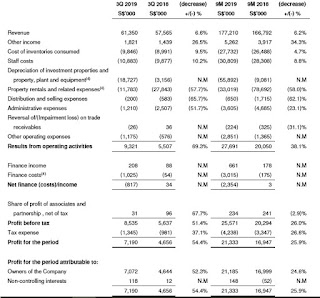

| Income Statement |

|

| Balance Sheet |

|

| Cashflow Part 1 |

|

| Cashflow Part 2 |

|

| Share Price since IPO - Source: Yahoo |

1. Changes in financials occur due to SFRS 16: Leases

2. Previously, leases were stated under operating leases - these were expenses. Currently, they are capitalised - these became assets under PPE.

3. Under income statement, depreciation increases, property rental and related expenses decreases. In actual fact, total cost remained the same related to their leases.

4. When leases were capitalised, their deduction comes from "financing activities" and not "operating activities".

5. These changes resulted in significant increases (in fact, almost 3 times) in net cash from operating activities.

6. Free cash flow also increased significantly.

7. However, if the S$48 million of leases under "financing activites" were deducted, the free cash flow will have been lower.

Many investors who do not read financials but solely follow many website indication of PCF or PFCF, will not have known about this issue.

There are many other issues that I pointed out during the seminar, but I prefer not to write here.

Oh... just 1 more point - Period of Moratorium is usually 6 months. If you look closer at the share price changes, you will understand even more about the company.

Anyway we hope to see more participants for our next FATA seminars. Do note that other than pointing out issues, I also provided an interesting company listed in US.

If you want to know more about other interesting finds in the company or other companies, feel free to join our Fundamental Scorecard Telegram Group.

Comments

Post a Comment