2021 Strategy Series: Nutryfarm – AZT

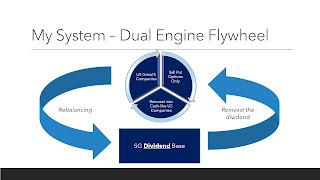

Not Vested at Point of Writing and may/may not invest in it over the next 72 hrs. If you remember my strategy of my portfolio, I do STILL invest in SG companies. It is my form of recovery stocks or it acts as a hedge towards my heavily invested US growth stocks. In other words, rather than going to the US and find recovery stocks, I tend to prefer to find them in SG market here. So here I am going to talk about another company that I am still considering whether to buy in view of its recent run up. I got to know this company when a friend asked me about it. Part 1 – What the Company Does? Ignore what the company does in the past. Basically, to know this company. we should know what it could possibility become. This company will eventually become a trading firm to assist Thailand Durian farms to shipped their Durians to China. Yes and to repeat, the business will eventually become a trading durian business between Thailand and China. The reason for this is the change in CEO as of Jan 21...