Not Vested at Point of Writing and may/may not invest in it over the next 72 hrs.

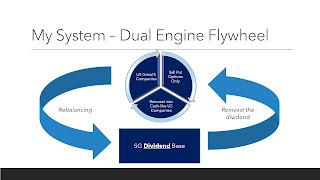

If you remember my strategy of my portfolio, I do STILL invest in SG companies. It is my form of recovery stocks or it acts as a hedge towards my heavily invested US growth stocks. In other words, rather than going to the US and find recovery stocks, I tend to prefer to find them in SG market here.

So here I am going to talk about another company that I am still considering whether to buy in view of its recent run up.

I got to know this company when a friend asked me about it.

Part 1 – What the Company Does?

Ignore what the company does in the past.

Basically, to know this company. we should know what it could possibility become.

This company will eventually become a trading firm to assist Thailand Durian farms to shipped their Durians to China.

Yes and to repeat, the business will eventually become a trading durian business between Thailand and China.

The reason for this is the change in CEO as of Jan 21.

As per

Next Insight Article stated,

“an industry veteran of the durian business in Thailand, Mr. Cheng was the founder and director of One Family (Thai) Company Limited incorporated in Thailand in 2016.It is principally in the business of plantation, and value-added processing of durians and exporting durians from Thailand to China mainly.

After a series of corporate moves, including a placement of 13,300,000 shares to him (at 4 cents apiece), Mr Cheng was appointed its CEO on 6 January 2021.

His stake in NutryFarm stands at 11.52%.

Why did Mr Cheng switch from his family business to join NutryFarm? It is likely that he saw the listed company as a vehicle that can significantly scale up the durian/fruit business and manage large working capital and receivables.”

Upon coming on board as the CEO, rapid changes have follows:

Based on

Press Release on 17 Mar 21 -

“Reference the announcements on 28 December 2020 and 8, 18 and 29 January 2021, the Group has entered into various agreements to sell over 1,480 containers of fresh durians from Thailand to major Chinese fruit importers since December 2020. The total contract value of these agreements is estimated at approximately RMB 962.0 million as announced on 13 February 2021. At the same time, together with RFG and TTT, the Group has todate entered into purchase agreements to purchase 870 containers of fresh durians from the plantations to fulfill the orders. Shipments have already started since 20 February 2021 and will continue through the course of the year.”

Note that this press release is in RMB. Their Annual Report and Q1 are in HK. After converting RMB$962m, the estimated revenue is about S$197m or HK$1.14bn.

Part 2: The Segment of Fundamental Scorecard That Caught My Eyes

Fundamental Scorecard is a

visualization tool that

simplify all quantitative information into graphs while

calculating the intrinsic value using

timeless theories, and

providing conclusions about the company for the reader to have an easier time to make decision.

(If you are interested, do click on this link).

Just to be clear, everything looks quite bad. The main positive is that the cashflow is looking good and on a improving trend.

Nevertheless, as I stated, these are PAST financials. We have to LOOK FORWARD when reviewing this company.

Part 3: My Qualitative Research with USCCR

Similar to Fundamental Scorecard, USCCR is my own simple way of doing Qualitative Research. Qualitative research is important because it Builds Conviction of a company you are intending to buy or is holding, even if the whole world is against you. It will Reduces the chances for you to make Rash Decisions that you may regret later.

Understand the Business – To be honest, I am not interested in its health food products. But based on its latest Q1 report, the income statement has shown some improvement. Nevertheless, what I am interested in the company is in near term (by 2021), most of its revenue will be from this Durian trading business.

Scalable / Macro Trend – China demand from Durian.

Competition – Malaysia Frozen Durian (?).

Catalyst / Future Growth – Possibility of renewing of contracts from the China customers.

Risk – Change in Government Policy, Possibility of higher operating cost, Unforeseen Delays

To explain further:

1. On demand from China.

As per the Nextinsight Article, it is stated that:

- Between 2009 and 2019, China’s fresh durian imports grew nine-fold, from US$124 million (S$169 million) to US$1.1 billion, according to a Channelnews Asia report.

- If that sounds unbelievable, consider that in 2020, the figure doubled to US$2.2 billion, according to the Ministry of Agriculture and Cooperatives of Thailand.

- Thailand is the only country allowed to export fresh whole durians directly to China under a 2003 trade agreement.

2. Malaysia Frozen Durian - There are talks that Malaysia Durian are also in demand. But Malaysia Supply will also need to cater to Singaporeans, which has a huge . Thus, if the China prefer Fresh Durian, Thailand will become their sole supplier.

3. On Risks - there are just too much risk involved currently with significant uncertainty and the share price running up in a short time frame.

On the other hand, as per the NextInsight Article, Raffles Financial Pte Ltd invested $5 million for 10,000,000 shares in Singapore-listed NutryFarm through a married deal with a substantial shareholder, as announced on the SGX website on 12 March 2021. I don’t think any finance house will just any how invest like that.

Conclusion

I did some maths. Solely on a financial point of view and from a PE perspective –

*Do note that most of the existing business figure are extrapolate from Q1 financials.

*For Durian Business, Gross Margin of Durian Business is taken from a press release. Operating Expenses are deemed as 1 times or 1.5 times of the existing business.

It seems that based on the current share price, the good news is already priced in. But if the company shows signs of expanding the durian business beyond the current volume, then there is a good chance that the current share price maybe deems undervalued. After all, Raffles Financial Pte Ltd purchased at S$0.5 per share.

I may just dip and nibble a bit and then wait for more possible good news.

If you are interested, please do bookmark this Blog or follow me on TUBInvesting FB, or Fundamental Scorecard Telegram Group (please google for the links!).

Stay tune for my next post!

Comments

Post a Comment