The 10x to 100x Framework

Firstly, I like to apologize for my slient lately.

I just came out of my hibernation after finishing the 100 bagger book by Christopher Mayer.

If you have read my 28 April post – I am getting slightly tired of the market. I probably need some new excitement in my stock investing journey. Thus, one of my friends introduced the above book to me.

I had not read in some time, so the book came at the right time. In addition, I decided to proceed to read the book because it seems to suit my current mindset right now – finding a great company and hold on to it, without significantly monitoring the market.

Basically, focusing on monitoring the company instead of the market.

Furthermore, as usual, whenever I get new inspiration, I will try to provide my own opinion and create it into my own framework.

Yeah… I do this all the time…

Please note that I have 2 portfolios – 1st one is mixed SG with US companies. 2nd one has 90% US companies.

This framework will be solely for the 2nd portfolio and solely for US companies. It is also an expansion of my USCCR Framework.

Here we go!

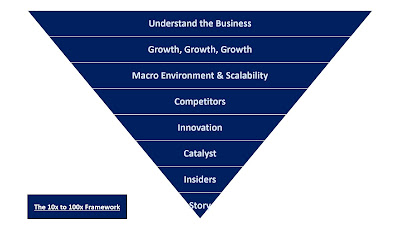

The 10x to 100x Framework

Pointers to take note before reading the Framework:

- Read with an open mind

- The idea is to find companies with great business model that has the potential to reach 10x based on its existing business model, and then IMAGINE how the business model could improve/innovate further into the future and allow the company to reach 100x. Basically we have to think in the mind of the founder – Be the founder.

- 10x will take a long time to reach. 100x takes a longer time. Some even state that it could take 20 years or more.

- Break away from the stereotype of the existing business model that reaches 100x.

- Break away from the stereotype of the current market cap.

- 20 years is a long time. Many things could change. Look at how handphone has become a smartphone. We also never expect FB to reach the current market cap when it just started.

- We need to have imagination.

- Portfolio wise – we must try to concentrate as much as possible till the edge where any “more” you will not be able to sleep well at night.

- This is a 8+1 criteria for this framework.

- This is only a framework. It should only be used as a guide. If a company is able to pass all criteria does not guarantee that a company could reach 10x or 100x.

1. Understand the Business –

We have to understand the strategy and potential future expansion plan of the company. Such as the segmentation of the revenue between the business model and the geographies. Having a trend might also be able to allow the understanding to be better.

2. Growth Growth Growth –

Growth on a whole is the most important aspect of a company to reach 10x and then 100x. This can be related to an increasing revenue growth, profit growth, gross margin, net profit margin, ROE, ROIC, ROA, PS and PE ratio.

In addition, losses/high ratios/52 weeks high should not be deter one to believe that a company will not reach 10x or even 100x.

Do note that based on a research done by me previously, an increasing exponential revenue growth will lead to increasing PS ratio.

3. Macro Environment & Scalability –

The main point here is to understand if the overall sector/industry is expanding.

For example, if the existing TAM is huge but not growing, the eventual growth may not be huge. Thus, the inability for the company to reach 10x or 100x.

There is also a need to understand the real industry behind the company and if the company has any story that can be link to this macro trend.

4. Competitors –

Although having competitors does not mean the company will not reach 10x or 100x, but having lesser competition in the existing industry will provide your company an easier time to reach the objectives provided the TAM is huge or continues to grow.

If the TAM is huge but there is a lot of competition, unless your company is the biggest or has the most potential, then it will be hard to reach 10x or 100x. On the other hand, if an industry has a small but growing TAM, it may not attract competition now. That may also allow your company to reach 10x first.

Finally, the analysis of the competitors will allow you to determine if your company has a moat/competitive edge within its industry. There is a need to have a detail check on each competitor product and services is require to see if they can really compete with the company

5. Innovation –

Companies need to continue to innovate in order to grow constantly and be on the forefront of its industry all the time.

6. Catalyst –

Near term catalyst will probably helped with our conviction to hold and allowed the share price to jump.

7. Insiders –

The insiders' ownership are important. It ensures if the management actions will be in line with the expectations of the shareholders

Another point here is also to take note of the age of the CEO as you should expect him to be there for the next 20 years and to continue to push the boundaries.

8. Risk –

Every company will have risk. The understanding of the whole business and company will bring up the biggest risk of that the company will have. Knowing this risk will also bring about higher conviction to hold.

+1. Conclusion –

We need to be able to articulate how the company is able to reach 10x based on its existing products and services or near-term expected product or services within its industry.

Then we will also need to IMAGINE how the company can become 100x.

A point to note is that interview with the CEOs will make be crucial for the story to sleeve out the ideas from the CEO’s mind.

That's all for the 10x to 100x Framework.

Conclusion

I like to emphasize once again that this is solely my opinion of a framework of understanding how a company could reach 10x or 100x. It should solely be used as a guide and not a guarantee that every company that achieves all the necessary ticks will be a 10x or 100x.

Finally, the point of finding a 100x company does not mean that a company must reach 100x before you can sell. The fact is that if we aim so high, (1) it ensures that we dig deeper to understand the company, (2) have enough conviction to hold when the going gets tough and (3) even if the company does not reach 10x or 100x, it will at least become a high capital gain company within your portfolio.

If you are interested, please do bookmark this Blog or follow me on TUBInvesting FB, or Fundamental Scorecard Telegram Group (please google for the links!).

Stay tune for my next post!

Comments

Post a Comment