APPS FUD or Risk?

Vested with average share price of US$46 (with an initial share price of US$38.30 and also the use of options).

As per Wikipedia, Fear, uncertainty, and doubt (often shortened to FUD) is a propaganda tactic used in sales, marketing, public relations, politics, polling and cults. FUD is generally a strategy to influence perception by disseminating negative and dubious or false information and a manifestation of the appeal to fear.

I don’t want people to think I only want to hype up Digital Turbine

(APPS). All investment has risk. It just that I felt there are too many

positives going for APPS and the share price trending down right now seems

unjustified.

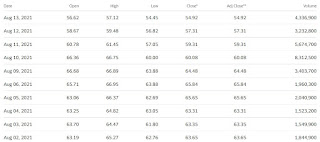

By looking at the high sales volume from 9 Aug onwards (more than the regular 1+m to 2m shares traded) and along with the comments and information from Reddit and Seeking Alpha, it is hard to believe these sale volumes is from retailers. I believe most of it should be from institutions, and then retailers actually followed.

|

| As per Yahoo Finance |

Why did institutions sell off? Institutions tend to be

longer term holders and a sell off could mean a fundamental changed view. What

could have changed?

I decided to investigate and came up with the pointers below.

Google kill APPS? Reliant on Google?

By now, you should know APPS business does rely on Android

significantly. If Google wants to “kill” its business, it can so easily. But

as explained previously, this is very unlikely. I will personally believe APPS

business model will have gotten the blessing from Google, and Google will not

want to be the “bad guy” that preloads apps into our new smartphone with all

the antitrust issue going on.

Furthermore, even with Google recent change from apk to aab, APPS even came out with an article that stated:

“Today we are currently

distributing Android App Bundles with many of our advertising partners across

all our on-device products, such as SingleTapTM and Dynamic Installs, Wizard,

Notifications and more.”

In addition, in terms of the privacy issue, Google has delays

its plans by 2 years as per article. With regards to Chrome, I am unsure of how this information APPS

taken from Chrome. But the delay should assist the company in changing their process if needed.

If you listen to this interview with CEO of Fyber (Offer Yehudai) it seems that APPS is not really using 3rd party cookies, as much. Also at the end of the interview, it also states that this privacy issue may eventually be a thing in the past in 1 or 2 years’ time, which I personally believe as well.

However, I must still comment that there is a very small

possibility that Google might no choice but to kill off the

relationship with APPS, only if the US government did something that requires that

to happen.

Gross Margin and FCF

Based on the latest 10Q , we knew that the Gross Profit

margin has fallen due to the Gross Margin of Adcolony and Fyber being much lower. This was unknown

previously to the institutions (maybe? Despite fyber being a listed firm last

time) so after learning about it they sold their positions.

|

| 10Q |

Another possibility is that maybe the lack of FCF this quarter cause them to sell the positions, since APPS has been having FCF for the last few quarters since turning around.

Regardless, I think both issues occurred due to the acquisitions that was only completed only in last 2 months. Give the company more time to cross sell and synergized – things will be different in 1 years time.

|

| 10Q |

Open App Market Act

I found this somewhere when one of the user mentioned it on Reddit.

To be honest, I don’t really know what needs to be done or undone.

In my opinion, this is even better to APPS since it stated

this in their latest earnings call:

“I should start with our overriding mission statement, which

is to become the largest independent mobile advertising and monetization

platform, leveraging our unique on-device technology and long-term partner in

advertising relationships.”

Being independent will allow it to work with more partners

and companies. Thus, if this act creates more app stores, it will probably mean

more businesses for APPS.

Adcolony and Fyber

There was a comment in my FB post that mention Adcolony and Fyber are not good enough and states

that “usually the bigger companies will go with a bigger agency or network, cos

more efficient, more partners, bigger network, better pricings. Most

importantly, better compliance, small networks tend to have less strict

oversight and u might catch porn ads leaking through. Tradedesk, magnite,

groupM, DV360 some of the big ones. adcolony used to have sg office, they went

thru some hard times, closed down and downsized.”

I am not debating on this point because I may not have enough knowledge on the Adtech Industry as compare to others.

However, as stated in my telegram group, I stated

that “I dont think they (Adcolony and

Fyber) are top notch platforms. But the potential is there to be one. If they

are top notch. APPS will not have been able to pay $$ for them. For example,

Magnite is over 4b. I dont think APPS will pay so much for it.”

We have to understand APPS paid US$700m in cash and shares

for Adcolony and Fyber – whose revenue are growing quite well at 46% and 200%

year-on-year. In addition, we have yet to see any sort of cross selling effects

and synergies in operations. I do believe these 2 companies will eventually

bring APPS to a greater height in 1 years' time.

Conclusion

In short, I believe the institutions may be wrong in selling

their positions too early. A lot of issues were due to the acquisition and we

should give APPS more time to blend and grow. With so many positives stated in

my last post, the future is definitely bright for APPS.

However, the main concern should be Google “killing” off the relationship with APPS. But the probability is low now in my opinion.

Further, APPS CEO has mentioned the need to diversify more and more – which I felt they are moving in the right direction.

Thus, I will continue to hold my positions and add if the share price continues to trend further downwards.

I forget to add another information - which is APPS was removed from russell microcap index which could be another reason why some institution need to sell cause they track the index. https://seekingalpha.com/news/3706246-cleanspark-and-kopin-among-tech-stocks-to-added-to-russel-microcap-index-digital-turbine-and-cohu-among-deleted

ReplyDeleteThanks for the article :) and especially the comment about the russell microcap. I'm a long holder on APPS, and the only way I can see myself selling is to day trade it, with these swings nowadays pffft might work.

ReplyDeleteHi JeFawk,

DeleteDay trading it is 1 possibility of "averaging down". But with all methods, comes the risk.

I use options due to the longer "tenure"

Regards,

TUB

APPS is looking quite nice uptrend now... I am glad i held on even when it dipped to the 40+...

ReplyDeleteHi Ralphlim,

DeleteCongrats!

TUB