Free Cash Flow Is Going To Cost You

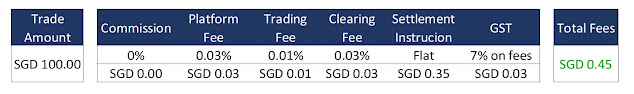

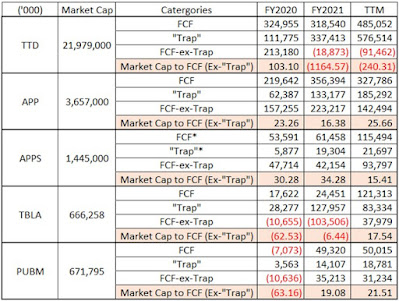

Investing can feel like you’re at war sometime. And while there are no silver bullets that can help you choose the best company to invest in, many (claim to) have found potent ammunition in free cash flow (FCF) . FCF refers to the cash, a company has remaining after deducting its capital expenditure, that can be used to repays creditors, or as dividends to investors. At the risk of oversimplifying this, it generally measures what a company can return to its equity investors, if it has no debt — which is exactly what you are looking for as an investor. FCF is also a widely used metric in investment banks and hedge funds, making it seem like a reliable weapon to add to your arsenal for financial analysis. Source: Yahoo Finance To me, it sounds more like a glamorous piece of silver laid in front of a trap. Just look at the top ad tech firms over the past 3 years. By accounting for this “trap”, many of the most attractive companies to invest in, such as The Trade Desk, sin...