Updates On My Top 10 Positions (Including The $21.8K Portfolio)

Its been some time since I updated my portfolios.

To recap, I have a few on-going portfolios (including the new $21.8k portfolio*) that I am managing. Thus, this update is a result of the consolidation of all companies in the various portfolios.

*Note that I will not be updating the $21.8k portfolio separately. But I will write an article on it once the whole experiment ended.

In the last update of my positions, I have already mentioned that things are not looking good in my portfolios, especially since I was more of a small cap investor.

The market has been on a further downward trend as a result of recent macro events such as the Ukraine-Russia war and potential Fed interest rate hikes, and this is reflected in my portfolio as well.

Somehow my portfolio may have went back to March 2020 levels.

With the released of the recent quarterly earnings, I have further consolidated the positions through the following actions:

Sold 2 of my previous Top 10 positions - Disney and Cerence

Disney

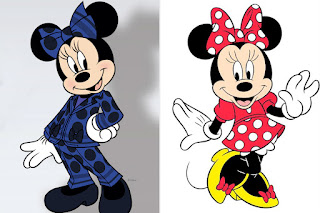

My reasons were that (1) Bob Chapek sounds like he has no idea with the intention to venture into everything new like metaverse and NFT, (2) Disney parks are probably still losing money with Shanghai and Hong Kong closed for some time in the last quarter of 2021, (3) Movies like Eternal are not doing well and the best movie is Spiderman No Way Home, which is a collaboration with Sony, and (4) my opinion of Disney+ may not be that good if you are not a marvel or star wars fan. (5) Finally, they alter Minnie to wear pants - How can Disney suddenly change an IP?

|

| Image taken from People Website |

In short, I believe Disney will have negative FCF this year with a reduction of dividend.

I was right that they have negative FCF, but I was wrong as the market only looked at the subscription numbers. This was sold prior to the release of the results and I missed the run up.

Cerence

My reasons were as follows: (1) Former management recorded their variable license fee, which is their bread and butter, in advance. This will have hindered their potential revenue growth over the next 2 years. Even if they achieve substantial design victories, it will take 18 to 24 months for each concept to reach mass production. (2) According to the most recent transcript, the CEO has no idea how to turn things around. (3) As a result of supply chain concerns, automakers will restrict output, reducing revenue from license fees. This will further impact their revenue.In my opinion, I still believe this is a good business cause (1) 50% of the cars globally are using their tech, (2) the future of self driving will require a personal assistance, (3) Their design win rates are about 8 out of 10 coupled with (4) expansion into 2 wheelers and elevators.

But my main issue is I do not trust the management now. Therefore, I sold everything at almost 50% losses. I am still holding onto a put option now that expires in Nov 2022.

Other Actions

- I have also reduced my position in Alibaba.

- Sold off some companies not within my top 10 positions for consolidation.

- But I also added around 3 new positions - with 2 reflecting in the Top 10 positions - Google and Bukit Sembawang (Recent write up on Bukit Sembawang - Part 1 and Part 2).

1. Digital Turbine (APPS) - 14.8%

2. Tencent (0700) - 14.5%

3. Alphabet (GOOG) - 11.3%

4. Bukit Sembawang (B61) - 10.0%

5. Alibaba (9988) - 7.1%

6. CapitaLand Integrated Commercial Trust (C38U) - 6.7%

7. Hut 8 Mining (HUT) - 5.3%

8. Palantir (PLTR) - 5.0%

9. FuboTV (FUBO) - 4.4%

10. Tesla (TSLA) - 4.2%

As per my last update on 23 Jan 22, there were still 18 companies in my portfolio. It has been trimmed down to 15 companies now.

Currently, the Top 10 positions contributes to 83.4% of the combined portfolio, with the Top 5 contributing 57.7%.

Moving forward, I believe that simply believing in FA is no longer sufficient. With so much uncertainty in the air and the market on the decline, knowing the TA of each firm in the portfolio is more important than ever.

And that's exactly what I've done in the last two posts for APPS and FUBO.

If you had read till here and I have value-added to your investment journey, please support by clicking into the Google Ads if it interest you!

Appreciate!

Stay tuned for the next write up!

Disney has not paid a dividend since 2019 so there's nothing to cut

ReplyDeleteHi Mailailuan,

DeleteNoted. Apologies. Regardless, I am probably too negative about it to hold on to Disney.

Regards,

TUB