Digital Turbine (APPS): A Contrarian Investment During An Inflationary Period

As you may be aware, I had been contributing to Seeking Alpha.

I just submitted another Digital Turbine (APPS) article to Seeking Alpha, less than two months after my first, and it was denied because a quarterly update was preferred or if there were major changes. As a result, because I had already written about it, I chose to put it here instead.

I was writing about investing in APPS amid a period of inflation.

It wasn't a forced narrative; rather, I did my homework and understood why Digital Turbine might thrive during this inflationary moment.

As a result, I hope this article can help you strengthen your resolve during this trying time.

Investment Thesis

In my previous article, I had already explain that Digital Turbine (APPS) is a capital allocation machine that has a moat on an exponential growth path with numerous catalysts ahead.

However, in this article, I will look at Digital Turbine as a extremely favorable investment during times of inflation.

This may sound absurd, but do hear me out.

Misconception On Advertising During an Inflationary Period

Most of us did not encounter periods of significant inflation when we first began investing. After all, the last time US saw more than 6% inflation was in 1990, and the last time it experienced more than 7% inflation was in 1981.

Therefore, most investors are unfamiliar with inflation.

During an inflationary period, when consumers are under cost pressure and governments tend to raise interest rates, the economy has the potential to enter a recession.

As a result, it is reasonable to expect that companies will reduce marketing expenses in order to cut costs.

However, in today's world, this is no longer true, according to a Harvard Business Review article published in August 2020, which states:

"Companies that have bounced back most strongly from previous recessions usually did not cut their marketing spend, and in many cases actually increased it."

and concluded with:

"This is a time not to stop spending money but a time to change how you spend it. It is also an opportunity, because firms who are willing to be what customers need in a recession get to keep many of the new customers they get — and cement the loyalty of those they already had."

In another Forbes article, it explains:

"According to Nielsen, “Brands that go totally dark for the rest of 2020 could be facing revenue declines of up to 11% in 2021.” And because it takes up to five years of brand building to recover from these dark periods, it’s important to consider the long-term effects of pausing spend."

It is important to note that many companies, particularly those in the Fortune 500, will have realized this and will have engaged in more aggressive marketing during periods of inflations and recessions.

After all, there's a saying that goes "When times are good, you should advertise. When times are bad, you MUST advertise!"

Digital Turbine's Potential TAM During an Inflationary Period

Once you've determined why advertisers will continue to advertise amid a crisis, it's essential to comprehend current advertising trends that will define APPS's TAM.

(1) Mobile Ad Spend Will Continue To Grow In 2022

APPS's main line of business is in mobile advertising.

As quoted from the App Annie's Press Release on Jan 2022 with regards to Mobile Ad spending in 2021:

"Publishers released 2 million new apps and games, bringing the cumulative total to 21 million.

Despite IDFA, advertising spend topped $295 billion, up 23% year over year, and is estimated to top $350 billion next year."

This meant that while mobile ad spending is likely to rise in 2022, competition is also expected to rise.

Companies with apps that want to stand out will want to collaborate with APPS, particularly on its Ignite On-Device Platform, which is already installed on over 800 million Android devices.

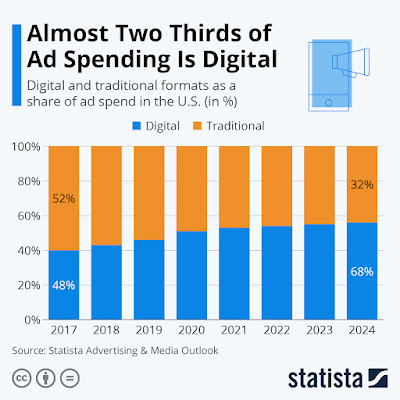

(2) At Least 1/3 of Advertising Is Still Traditional Advertising by 2024

|

| Image from Statista on Traditional vs Digital Ad Spend |

Following the pandemic in March 2020, there has been a greater emphasis on becoming digital. Furthermore, digital advertising is more cost effective, which will appeal to advertisers during an inflation period.

According to a 2020 Statista article, conventional media will still account for at least 30% of advertising spend.

On the other hand, as per previous Forbes article states that:

"In the aftermath of the last recession in 2008, ad spending in the U.S. dropped by 13%. Broken out by medium, newspaper ad spending dropped the most at 27%, radio spending dropped by 22%, followed by magazines with a decline of 18%, out-of-home by 11%, television by 5% and online by 2%."

This meant that in the event of a crisis, firms are considerably more likely to reduce their advertising budgets on traditional media than on digital media. This may even lead to an increase in the usage of digital advertising in order to maximize returns.

Overall, APPS will benefit in 2022 as its potential TAM grows, and as more advertisers shift their budgets from traditional to digital advertising during the inflationary period.

Digital Turbine Edge During an Inflationary Period

During an inflationary period, when consumers are impacted by cost pressures and businesses are expecting a potential reduction in revenue, advertisers will seek a greater conversion rate among a larger pool of targeted customers in terms of any marketing/advertising spend.

APPS addresses these challenges head-on through:

(1) Ignite On-Device Platform and SingleTap

In my earlier post, I discussed the Ignite On-Device Platform. It essentially facilitates app discovery upon the first activation of a new smartphone and is already present in over 800 million Android smartphones.

SingleTap, on the other hand, allows an app to be installed in the background while you continue to play a game or operate on the current app. This minimizes app store friction and boosts conversion by 30%. This product is already present in more than 150 million Android handsets.

Ignite On-Device Platform and SingleTap deliver apps straight to end users' mobile phones.

This will increase the likelihood of end-users using these apps, as well as conversion rates, with an ultimate potential beneficial effect on revenue for advertisers.

(2) Existing 35 OEM/Telecom Providers' Partnership

|

| Nov 21 Analyst Day Slide |

Advertisers will be able to tap into APPS's current 35 OEM and Telecom Provider partnerships and directly advertise to the end-users of these OEM and Telecom Providers.

(3) End-to-End AdTech Platform

APPS has evolved into an End-to-End AdTech Platform following the acquisitions of Appreciate, Adcolony, and Fyber.

As an End-to-End AdTech Platform, it will become a one-stop platform for advertisers, and similar to this article, there may be a cost reduction on the advertiser's advertising expense.

As a result of the aforementioned advantages, APPS will be able to distinguish itself among the AdTech Platforms throughout an inflationary environment.

Risk

In this thesis, the main risk is that prolonged inflation will eventually lead to a recession. This may eventually cause advertisers to reduce their marketing/advertising budgets, which may have an immediate impact on APPS's financials.

Mitigation - An unprofitable and cash-burning company will struggle to survive this crisis. However, APPS will not face such problems because it is profitable and has a positive free cash flow. Furthermore, with a number of ongoing positive catalysts in the background, such as the extended cooperation with Tik Tok, Telefonica, Samsung, Verizon, and AT&T, APPS financials are projected to improve in the near term.

Valuation

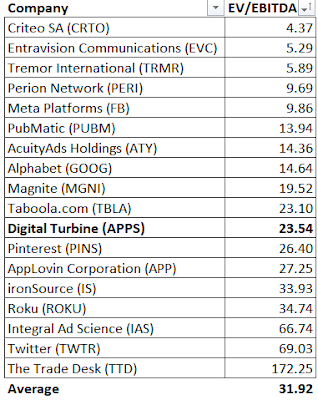

In my previous piece, I calculated APPS's valuation using the average EV/EBITDA of a peer group.

I'll be updating the EV/EBITDA for the comparable peer group and then determine the valuation for APPS.

|

| EV/EBITDA on 3 May 22 |

APPS's EV/EBITDA remains lower than the average EV/EBITDA, indicating that it is modestly undervalued in comparison to its peers.

Furthermore, if APPS can accomplish the $1bn EBITDA target in 3 to 5 years, based on the current EV/EBITDA of 23.54x, it will have the potential to attain an EV of $23bn - 6.9 times its current EV of $3.33bn!

Conclusion

Misconceptions about the advertising industry during an inflationary environment, as well as APPS's advantages to handle such a crisis, have led to the market unfairly punishing its share price, which has dropped 65.1 percent from its 52-week highs!

This allows regular investors like us to buy in and accumulate.

When APPS releases its financials and guidance in the first week of June, a clearer picture will emerge.

If you had read till here and I have value-added to your investment journey, please support by clicking into the Google Ads if it interest you or signing up to the uSMART Platform!

Appreciate!

Stay tuned for the next write up!

Great thesis. However, if you were to exclude the EV/EBITDA of The Trade Desk as an outlier, the Average would be 23.7x, indicating that APPS is fairly priced.

ReplyDeleteHi,

DeleteApologies for the late response. This comment was in spam.

Regardless, appreciate!

Regards,

TUB