TUB Snippets: Beng Kuang Marine Ltd (BEZ)

Not Vested in Dyna-Mac and BEZ at time of writing.

Since April 25th, the share price of Dyna-Mac has increased by about 100%. According to the article, this is most likely a record high net book order of S$641.1 million for floating production, storage, and offloading vessel topsides modules (FPSO), with deliveries extending through 2024.

|

| Share Price of Dyna-Mac |

This is related to the oil supply scarcity > resulting to an increase in oil prices > increasing the demand for oil exploration/storage/transportation > leading to higher demand for FPSO.

This prompted me to conduct research on the FPSO industry, which led me to Beng Kuang Marine (BEZ), whose share price has been declining instead.

This made me wonder if this is an opportunity?

|

| Share price of Beng Kuang Marine |

|

| Revenue Breakdown |

My Opinion

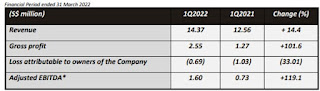

According to the financials, BEZ appears to be on a turnaround driven by its IE business division. Despite the absence of revenue from SH, it reported stronger revenue, as well as better gross profit and EBITDA.

Furthermore, its IE business is different from Dyna-Mac. BEZ focuses on repairs and maintenance, rather than building of FPSOs.

So this seems like an opportunity.

More FPSOs will be purchased for repair and maintenance in order to improve operational efficiency. Furthermore, with more FPSO being built around the world in the future, there will undoubtedly be more FPSO due for repairs as well.

We should also keep in mind that BEZ also has a CP segment that complements the IE business and offers consumers one-stop repair and maintenance services for their FPSO and FSO.

If you had read till here and I have value-added to your investment journey, please support by clicking into the Google Ads if it interest you!

Appreciate!

Stay tuned for the next write up!

Comments

Post a Comment