uSMART - The SMART-er Plan for the uncertainties ahead!

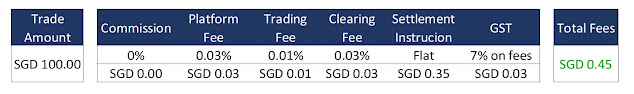

In our previous article from April , we covered how uSMART is a fuss free trading platform suitable for investors. Recently, uSMART has further upped the ease in which a young adult can invest through their new SMART Plan feature. It is our belief that the best way to learn about investing and financial markets is through putting your own money to work. However, as a new investor starting out, you have experienced: Minimum fees being charged forming a huge proportion of your investment quantum and The inertia of logging into a trading platform at regular intervals, and manually keying in orders each time you want to make an investment. The SMART Plan helps you overcome these 2 main hurdles to enable a smoother and more efficient investing process. uSMART SMART Plan uSMART SMART Plan is an auto investing feature within the uSMART platform that helps you to invest a fixed sum on a regular basis, allowing you to steadily build up your investment portfolio, even if you do not have a huge l...