In our previous article from April, we covered how uSMART is a fuss free trading platform suitable for investors. Recently, uSMART has further upped the ease in which a young adult can invest through their new SMART Plan feature.

It is our belief that the best way to learn about investing and financial markets is through putting your own money to work. However, as a new investor starting out, you have experienced:

- Minimum fees being charged forming a huge proportion of your investment quantum and

- The inertia of logging into a trading platform at regular intervals, and manually keying in orders each time you want to make an investment.

The SMART Plan helps you overcome these 2 main hurdles to enable a smoother and more efficient investing process.

uSMART SMART Plan

uSMART SMART Plan is an auto investing feature within the uSMART platform that helps you to invest a fixed sum on a regular basis, allowing you to steadily build up your investment portfolio, even if you do not have a huge lump sum to begin with.

Some notable features of the SMART Plan are:

• Low SGD 100 / USD 100 minimum amount per order

The SMART Plan allows you to on a periodic basis with as little as SGD 100 / USD 100 per investment. If you are not yet drawing a high salary (don’t worry, it will grow!), this low minimum is perfect for you to get started on your investing journey.

• Customizable investment frequency

You will have the option to select a specific investment frequency, choosing between Daily, Weekly to Monthly options. Our own recommendation: Set up the SMART Plan and time it with your salary crediting date to “

Pay Yourself First”, as a good financial practice.

• Convenient account deduction via uSMART account / eGIRO

You can use your uSMART account as source of funds for the recurring investment or set up a recurring eGIRO instructions (our pick!). With the eGIRO mode, the investment amount gets automatically debited from your bank account on your chosen investment date. Do note that if your investment amount is in USD, the amount in SGD debited from your bank account will fluctuate due to the fluctuations in foreign exchange rates.

There are no additional fees from using the SMART Plan feature

How to maximize your uSMART SMART Plan

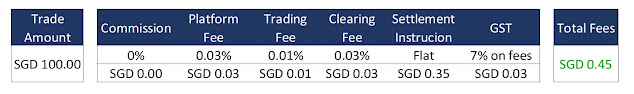

Back in April, we also shared that uSMART is currently the cheapest brokerage in town for investing in SGX shares. Our comparison as of 19 September 2022 still shows this to be true.

As uSMART has no minimum fee for an investment into SGX shares,

T.U.B Investing recommends setting up a monthly recurring investment into blue-chip SGX shares as an efficient way to

Dollar Cost Average, given the volatility of the markets currently.

Assuming an investment amount of SGD 100, each monthly investment will only cost SGD 0.45 or 0.45% of the total.

Currently there is also a No Commission promotion until 31 December 2022. Commission will revert to 0.03% after the promotion ends.

Setting Up Your SMART Plan

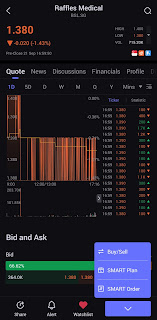

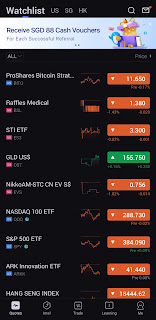

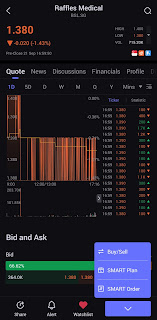

1. Locate the Stock or ETF you wish to set up the SMART Plan for under “Quotes” at the bottom task bar. In this example, to take advantage of the low SGX fee amount, we are going to set up a SMART Plan to purchase Raffles Medical Group (SGX:BSL).

2. Select the Buy/Sell tab on the bottom right, and choose “SMART Plan” from the list of options available.

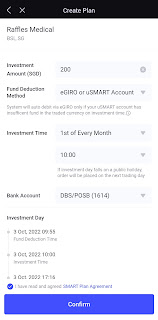

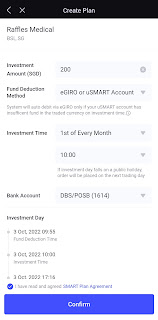

3. Enter the following details needed to start your SMART Plan:

- Investment Amount (SGD): This is the amount that will be deducted every month from your account (Note that the amount cannot be lower than 1 lot of the selected share, in our example, Raffles Medical is currently trading at SGD 1.380 per share, with a SGX-defined lot size of 100 shares. Hence the minimum amount you can set will be SGD 138, we used SGD 200 in our example for illustration purposes)

- Fund Deduction Method: There will be 3 options, “eGIRO”, “uSMART Account”, and “eGIRO or uSMART Account”. We recommend choosing “eGIRO or uSMART Account” so that any amount gets deducted first from within the uSMART platform, and any remainder should there be insufficient funds then gets deducted from your eGIRO-linked bank account

- Investment Time: The first box allows you to indicate the frequency and date of deduction (Every Month, Week or Day), while the second box allows you to dictate the time of the day the investment will be performed.

- Bank Account: This option will only appear if eGIRO is included as one of the Fund Deduction Methods. Indicate your specified bank account for the deduction to take place.

Read the SMART Plan Agreement at the bottom of the screen, and select the check box once you have done so, and click “Confirm” to execute your plan.

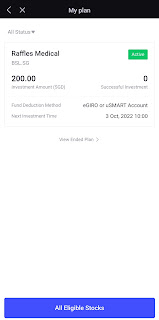

4. Once the SMART Plan has been successfully set up, the status will indicate “Active” in green

Set up your SMART Plan to regularly Invest in SGX with the lowest fees on the market today!

For more information, do check out the

FAQ.

SIGN up with uSMART to start your low cost investing journey today!

Disclaimer: This article is written in collaboration with uSMART Singapore. All views expressed in the article are the independent opinions of mine. This article is intended for information purpose only and should not be construed as financial advice. This article has not been reviewed by the Monetary Authority of Singapore

Comments

Post a Comment