My (Current) Roadmap to Choosing Companies

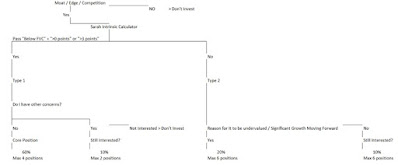

To call the current market situation turbulent would be an understatement. And to understand why, you might want to read my articles “What is happening in the market?” followed by “Recession coming” . To wade our way through this impending storm, we need a plan. Here is mine. My primary objective will be to keep my portfolio as far out of the red as possible with companies that can take a hit, whist keeping an eye out for companies that may shoot to the moon after recession dwindles. To do that, I will be using 3 filters to differentiate companies into conservative, enduring ones and potential moonshots. If you’re on time, you can take a look at the diagram below. It summarizes my entire approach. Otherwise, a lengthier explanation can be found below the diagram. The Roadmap Filter 1: Find Companies with a Competitive Edge Almost every company is going to have to take a hit, but only the ones with a competitive edge in their industry are going to be able to survive the...