Take Your Portfolio From The Sewers To Cybertron With IDW

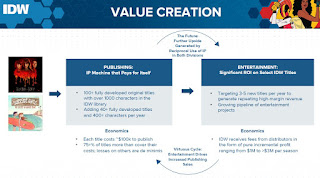

Although returning to write on the Seeking Alpha platform presented a challenge, I was able to gather the motivation to share my thoughts on a micro-cap company. But the article was still rejected due to the limited liquidity of the stock. Rejection does not equate to failure; rather, it provides a chance to refine and create better content. Even though Seeking Alpha didn't publish my article, I've decided to share it here instead. Thank you for taking the time to read my work. The Company IDW Media Holdings ( IDW ) is a leading American publishing company specializing in comic books, graphic novels, and trade paperbacks. Founded in 1999, IDW has built a reputation for producing high-quality, innovative content that appeals to a wide audience. With a focus on licensed properties and original titles, IDW has a portfolio of beloved brands that have captured the imaginations of readers around the world. These include the new Netflix hit Locke & Key, the ever-popular classic ...