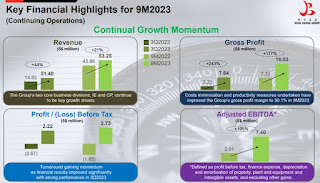

Revisiting Beng Kuang Marine: Profitability, Disposals, and Potential Opportunities

Not Vested. Considering. In my previous blog posts, I mentioned Beng Kuang Marine (BKM) a few times. I initially held a position in the company but divested when its share price increased significantly, as it was only a small portion of my portfolio. Based on my recent review of my portfolio strategy, I am not planning to reinvest in BKM unless it is solely for a separate trade outside of my portfolio. The current circumstances seem to indicate a potential opportunity has arrived. To summarize the situation: BKM has achieved profitability based on its Q3 FY23 results. This suggests that it is highly unlikely for FY23 to be a year of losses for the company. Source: BKM 3Q & 9m2023 Corporate Highlights Furthermore, BKM has successfully completed the disposal of its tugboats and has received the remaining S$460k in cash. This means that the company's financial results will no longer be negatively impacted by this unprofitable segment of its business In addition, BKM has collect...