Arigato Everyone! A Decade of Blogging!

I've been writing since 2015, and this blog has been going strong for almost ten years. Maybe it's time to wrap it up, or perhaps when I find more time.

If you've been following me, you've likely noticed I've been pulling back from social media. I've shut down most of my accounts, and there’s been minimal new content on this blog.

These days, I'm primarily active on X (formerly Twitter). Follow me there, and feel free to send me a DM if you want to connect. If you have my phone number, texting is always an option.

Just an update: my investment portfolio is still in the red, but it's doubled from its lowest point. Stepping away from social media has probably helped cut through the noise.

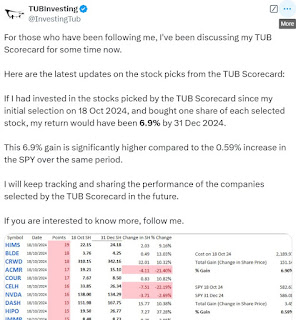

Before I sign off on this post, I wanted to share that I've gone back to basics and started working on a new scorecard, named the TUB Scorecard, tailored for the US market. It's showing promising results so far without any backtesting; I'm just monitoring its performance moving forward.

From 18 Oct to 31 Dec 2024, it achieved a 6.9% gain compared to the SPY's 0.59% gain over the same period.

|

| Screenshot of my X post |

As of now, my portfolio currently includes:

- PLTR

- SOFI

- TSLA

- PYPL

- AMZN

- UBER

- O

- GRAN

- KO

- SLB

- PATH

- OLO

- TALK

- BLDE

- BTBT

- PUBM

- VTSI

- Keppel Infrastructure Trust

Looking ahead to 2025, I anticipate a lot of volatility and change. Stay cautious and prepared.

Thank you for reading and following me for so long. It has been a great journey.

Comments

Post a Comment